Les Membres de ICA

En 2018, les membres de l'ICA se sont engagés à consacrer 20,2 milliards de dollars à l'infrastructure de l'Afrique, soit une augmentation par rapport à la moyenne de 19,4 milliards de dollars des trois années précédentes. Le financement des opérations énergétiques s'est élevé à 10,2 milliards de dollars, soit près de la moitié des engagements totaux, faisant du secteur de l'énergie le secteur qui a reçu la plus grande part du financement des membres de l'ICA pour la période 2014-2018, à l'exception de 2017, où le secteur du transport a reçu la plus grande part du financement. Le niveau de financement du secteur des transports, 3,9 milliards de dollars, est inférieur de 40 % à la moyenne de 6,6 milliards de dollars pour 2015-2017. Le financement de 5,1 milliards de dollars dans le secteur de l'eau et de l'assainissement en 2018 représente environ 25 % du total des engagements, correspondant à sa proportion en 2016 et 2017. Le secteur des TIC représentait 503 millions de dollars en engagements et les opérations multisectorielles 527 millions de dollars*.

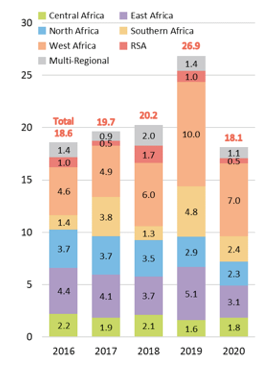

Les engagements par région montrent que l'Afrique de l'Ouest, avec 6 milliards de dollars, a reçu la plus grande part des engagements de 2018 (30 %), près de la moitié des engagements ciblant le secteur de l'énergie. L'Afrique de l'Est a représenté 18 % du total des engagements, soit 3,7 milliards de dollars. Les engagements en faveur de projets en Afrique centrale (2,1 milliards de dollars) ont représenté 10 % du total et reflètent une forte augmentation dans le secteur de l'énergie et une diminution substantielle dans le secteur des transports. Le niveau des engagements pour les opérations en Afrique du Nord, qui est de 3,5 milliards de dollars, représente 17 % du total en 2018. La diminution globale est le résultat de la réduction des transports, de l'énergie et des TIC.

Seul le secteur de l'eau et de l'assainissement a connu une augmentation des engagements. Les engagements en faveur de la région Afrique australe (hormis l'Afrique du Sud), qui sont de 1,3 milliard de dollars, ont été nettement inférieurs à la moyenne annuelle de 2,3 milliards de dollars déclarée pour 2015-2017. Les engagements en faveur de projets en Afrique subsaharienne, de 1,7 milliard de dollars, ont été beaucoup plus élevés que la moyenne des trois années précédentes (1,1 milliard de dollars) et ont été soutenus par les 1,1 milliard de dollars consacrés aux projets en énergie.

*Ce montant ne comprend pas les engagements de la Commission Européenne et du Royaume-Uni. A titre de référence, la Commission Européenne a toujours engagé en moyenne plus d'un milliard de dollars par an au cours de la période 2012-2016. Le Royaume-Uni a engagé 623 millions de dollars en 2017 et 569 millions de dollars en 2016 et a indiqué qu'il s'attendait à ce que ses engagements pour 2018 soient conformes à ceux de 2017.

ICA Members' Commitments by Source and Region ($m), 2019

ICA Members' Commitments by Source and Region ($m), 2020

Tendances des engagements des membres de ICA par secteur (en milliards de dollars), 2014-2018

Tendances des engagements des membres de ICA par région (en milliards de dollars), 2014-2018