Autres financements du secteur public

La Chine

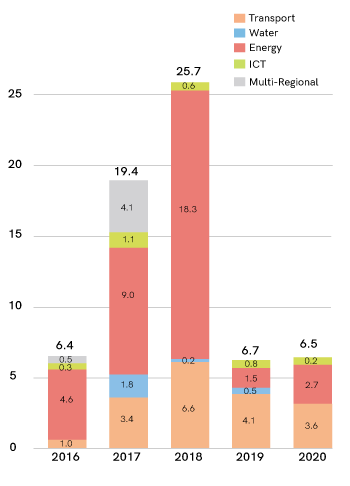

Les investissements et réalisations de la Chine dans les infrastructures en Afrique se sont élevés à 25,7 milliards de dollars en 2018 (American Enterprise Institution - China Global Investment Tracker - AEI-CGIT : www.aei.org/china-global-investment-tracker/)

Ceci correspond à une augmentation de 32 % par rapport aux 19,4 milliards de dollars enregistré en 2017. C'est l'engagement le plus élevé jamais enregistré depuis que ICA collecte de telles données; le niveau moyen des engagements est de 13,1 milliards de dollars par an sur la période 2011-2017.

La plus grande part du financement chinois (71 %) a été consacrée au secteur de l'énergie, qui s'élevait à 18,3 milliards de dollars. Dans le secteur des transports, les engagements chinois se sont élevés à 6,6 milliards de dollars en 2018, soit 26 % du financement total. Le financement de la Chine comprend également 550 millions de dollars pour les TIC et 230 millions de dollars pour l'eau et l'assainissement.

Engagements de la Chine par secteur (Millions de dollars), 2014-20188

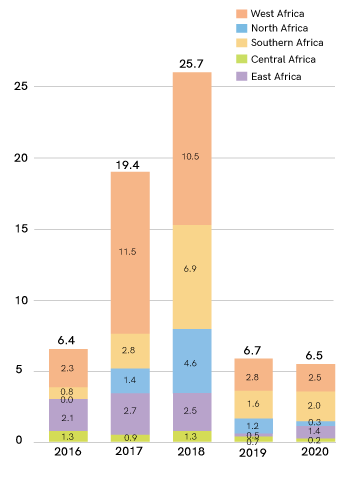

Les engagements de la Chine par Région (Millions de dollars), 2014-2018

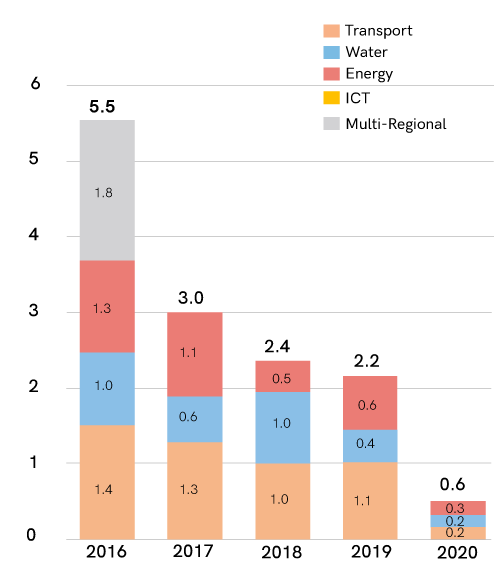

Le Groupe de Coordination Arabe

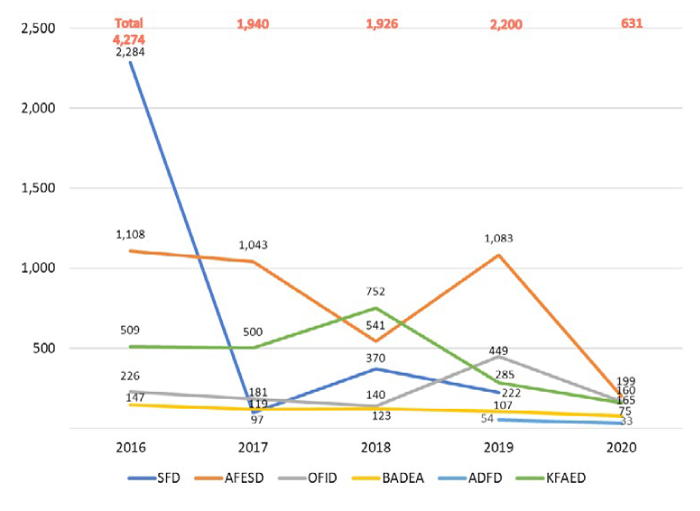

Le but du Groupe de Coordination (GC) est d'optimiser les ressources fournies par les membres pris individuellement aux pays arabes bénéficiaires en vue d'atteindre des objectifs communs. Le GC se comprends dix institutions, dont quatre sont des institutions nationales: le Fonds Koweïtien pour le Développement Economique Arabe (KFAED), le Fonds Saoudien pour le Développement (SFD), le Fonds d'Abu Dhabi pour le Développement (ADFD), le Fonds de Développement du Qatar (QDF), et cinq organisations régionales composées du Fonds Arabe pour le Développement Economique et Social (le Fonds arabe, AFESD), de la Banque Islamique de Développement (BIsD), du Fonds de l'OPEP pour le Développement International (OFID), de la Banque Arabe pour le Développement Economique en Afrique (BADEA), du Programme Arabe du Golfe pour les Organisations de Développement des Nations Unies (AGFUND) ainsi que du Fonds Monétaire Arabe (AMF). La GC s'est engagée à verser 2,4 milliards de dollars en 2018, soit beaucoup moins (20 %) que les 3 milliards de dollars engagés en 2017.

Le Fonds koweïtien (KFAED) a annoncé des engagements de 752 millions de dollars en 2018, soit 50 % de plus que ses engagements de 2017 (500 millions de dollars), et près de 50 % de plus que ses engagements de 2016 (509 millions de dollars). Plus de la moitié (57 %) des engagements totaux ont bénéficié au secteur des transports. Un prêt de 26 millions de dollars a permis la construction de quatre échangeurs à Conakry, en Guinée. Un engagement unique de 26 millions de dollars dans le secteur de l'énergie, sous la forme d'un prêt, soutient le financement du projet géothermique de la centrale électrique de Djibouti.

Le Fonds arabe (AFESD) a engagé 541 millions de dollars en 2018, soit environ la moitié du milliard de dollars engagé en 2017. 331 millions de dollars, soit 61 %, ont été consacrés au secteur de l'eau et de l'assainissement. Les engagements de 162 millions de dollars ont ciblé le secteur de l'énergie et 48 millions de dollars ont soutenu des projets de transport. Deux opérations ont été réalisées en Égypte : un prêt de 231 millions de dollars contribuera à la construction du projet de système de drainage de l'eau de Bahr El-Baqar. Un autre prêt de 132 millions de dollars contribuera à la construction de la deuxième phase du réseau électrique.

La Banque islamique de développement (BIsD) a engagé 518 millions de dollars en 2018, soit 13 % de moins que les 597 millions engagés en 2017. Sur les engagements de 2018, 284 millions de dollars (55 %) ont servi à financer une opération d'Energie en Tunisie. Le secteur des transports a reçu 137 millions de dollars d'engagements, dont 118 millions de dollars en faveur du Bénin pour la réhabilitation du corridor routier Cotonou-Niamey. La BIsD a engagé 97 millions de dollars dans le secteur de l'eau et de l'assainissement, dont 43 millions de dollars pour le projet d'assainissement de Conakry en Guinée.

Le Fonds saoudien de développement (SFD) a engagé près de 370 millions de dollars en 2018. Les engagements de SFD ont connu des fluctuations importantes au cours des dernières années : ils se sont élevés à 97 millions de dollars en 2017 et à 2,3 milliards de dollars en 2016. En 2018, les engagements ont ciblé deux secteurs, pour des montants très similaires : l'eau et l'assainissement ont reçu 187 millions de dollars et le secteur des transports 182 millions de dollars. L'engagement le plus important, un prêt de 122 millions de dollars, soutient le projet de la route Djibouti-Galafi à Djibouti. Un prêt de 86 millions de dollars soutient un projet d'approvisionnement en eau et d'assainissement en Tunisie pour améliorer l'approvisionnement en eau potable dans la zone rurale de la région de Bizerte.

Le Fonds OPEP pour le développement international (OFID) a engagé 140 millions de dollars en 2018, contre 181 millions en 2017 et 226 millions en 2016. 81 % (113 millions de dollars) du total des engagements ont ciblé le secteur des transports à l'appui de six opérations. Les engagements restants (27 millions de dollars) ont servi à financer deux projets d'approvisionnement en eau et d'assainissement. Les six projets de transport sont appuyés par des engagements de l'OFID allant de 12 à 25 millions de dollars pour chaque projet. L'un de ces engagements est un prêt de 20 millions de dollars au Burundi pour aider à financer le projet de réhabilitation de la route du lac Rumonge-Nyanza. AREDA, KFAED et SFD soutiennent également ce projet. L'OFID a également accordé un prêt de 12 millions de dollars à l'Ouganda pour cofinancer le projet routier Luwero-Butalangu. L'OFID a également engagé 15 millions de dollars pour appuyer le projet d'approvisionnement en eau potable dans la ville de Karonga au Malawi. La BADEA cofinance ce projet.

La Banque Arabe pour le Développement Economique en Afrique (BADEA) a engagé 123 millions de dollars en 2018 pour soutenir 8 projets d'infrastructures : 6 dans les transports et 2 dans le secteur de l'eau et de l'assainissement. Un prêt de 20 millions de dollars soutient l'extension de l'autoroute de l'aéroport international au centre-ville de Niamey (phase I). L'OFID et le Gouvernement nigérien cofinancent l'opération, avec des contributions respectives de 15 et 5 millions de dollars. En 2018, la BADEA a porté le plafond de financement de 20 millions de dollars à 40 millions de dollars pour répondre aux différents besoins des pays africains.

Engagements du Groupe de coordination arabe par membre (en millions de dollars), 2014-2018

The Saudi Fund for Development (SFD)

SFD committed $222m in 2019 for six infrastructure operations: one in water supply and sanitation: a $61m loan to Tunisia for the protection of cities and urban areas from flood. The other five operations are in the transport sector: (i) in Niger ($20m), the rehabilitation of the Loga-Doutchi Road; (ii) in Ethiopia ($75m), the rehabilitation and upgrading of the “Debre Markos-Motta” Road; (iii) in Burundi ($6m), an additional loan for the Bujumbura-Nyamatinga Road; (iv) in Gambia ($11m) for the construction of a VIP lounge at the Banjul International Airport; and (v) in Gambia, ($50m) a loan to improve roads in the Greater Banjul Area.

No information was available for 2020 commitments by SFD.

The Arab Fund for Economic and Social Development (the Arab Fund, AFESD)

AFESD committed $1.1bn in 2019 in support of six operations. This is double the $541m committed in 2018, and in line with the $1bn committed in 2017. Three transport loans ($540m) accounted for 50% of total 2019 commitments: $171m to Mauritania for a Mali border road project to contribute to the development of transport services on the main road network in the country; and $369m for two loans to Morocco for the construction of the Laayoune bypass expressway and the development of motorways. A water and sanitation loan ($247m) to Egypt aims at the establishment of a water system for the Bahr El Bakar Drain. Two energy loans ($296m) support the heightening of the Mohammed V dam in Morocco, and the construction of a 500kV transmission ring around Khartoum in Sudan.

In 2020, the Arab Fund committed $199m in support of one operation in energy in Djibouti ($98m) for the expansion and development of the Damerjog Power Plant, and two operations in water and sanitation in Mauritania, for a total of $101m, for the supply of drinking water to the Region of Aftout Elcharghi and the strengthening of the drinking water supply to the city of Nouadhibou.

The Kuwait Fund for Arab Economic Development (the Kuwait Fund, KFAED)

KFAED committed $285m in 2019 in support of nine operations. This is markedly less than the $752m it committed in 2018 and the $500m it committed in 2017. The six transport loans ($229m) represented 80% of commitments for that year. There were also three water and sanitation loans. Among the transport operations were two loans (both second loans) to Egypt for a total of $168m for the establishment of the Sharm El- Sheikh Tunnel Road, and the construction of the Ardhi 4 road. The three water and sanitation loans ($56m) were in Benin, Sierra Leone, and Togo.

In 2020, the KFAED committed $160m in support of four operations. The $82m energy loan to Sudan aims to increase electricity generation at the Al- Foula Auxiliary Bower Station. The 3 transport loans were one each in Cameroon (construction of a portion of a road in the South), Mauritania (construction of a 150km road in the East), and Senegal (road rehabilitation).

The OPEC Fund for International Development (the OPEC Fund, OFID)

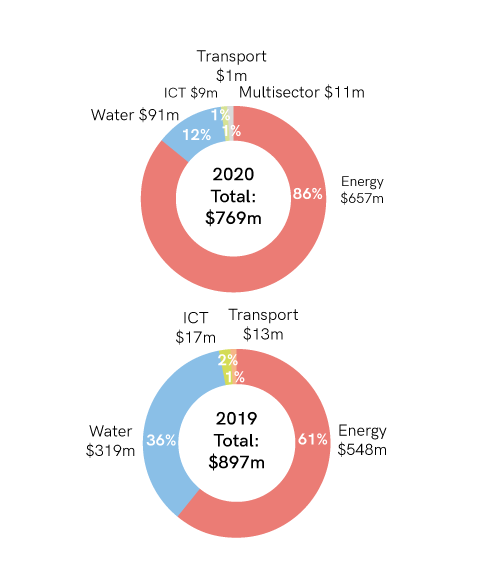

OFID committed $449m in 2019 in support of 18 operations in energy, transport, and water and sanitation, compared with $140m in 2018 and $181m in 2017. Commitments for the nine energy operations ($288m) represented 64% of total commitments for African infrastructure. Some of these supported the Temane Transmission Project in Mozambique ($36m), $40m to support Egypt’s energy security, and $45m to a private energy company in Côte d’Ivoire to develop a power plant. The OPEC Fund committed $81m in support of four transport operations, including $20m to Ghana for road construction and repair and $25m to Liberia for the upgrading of the Konia-Voinjama Road. The $80m commitments to water and sanitation operations supported, among others, $30m to DRC for the Ozone Water Supply Project, and $30m to Lesotho for the Lowlands Water Development Project in the Botha Bothe Region. The commitments also included $0.4m in grants to Chad and Ghana.

In 2020, the OPEC Fund committed $119m in support of four operations, one each in energy and transport, and 2 in water and sanitation, which, for a total of $60m, represented 51% of total 2020 commitments. One of these operations, the DRC Ozone Water Supply Project ($30m), aims to provide around 1.4 million people in western Kinshasa with clean drinking water by constructing supply infrastructure capable of producing 220,000 m3 of water per day. The $26m transport loan to Tanzania will support the upgrading of a 36 km stretch of the Kazilambwa-Chagu Road and will help ease transport constraints in in the central and western parts of the country. This will help boost agricultural and tourism activities and facilitate trade with neighboring Burundi and DRC.

The Arab Bank for Economic Development in Africa (BADEA)

BADEA committed $107m in 2019 in support of five transport operations. This is comparable to the $123m it committed in 2018 and the $97m it committed in 2017. The transport operations were: a $40m loan to Mali for the rehabilitation of a road and the construction of a bridge in the Mopti area; a $20m loan to Niger for the construction of a road in the Dosso Province; an additional loan of $7m to Burundi for the construction of a section of National Highway 5; a $20m loan to Madagascar for the construction of a bridge over the Mangoky River; and a $20m loan to Ethiopia for the upgrading of the Dila-Bole-Haro Wachu Road.

In 2020, BADEA committed $75m in support of two operations, one in energy and one in transport. The $50 million energy loan to Benin includes the supply and installation of high-tension lines, and three transmission stations. The $25m transport loan to Sierra Leone will support the construction of the Btemba-Matrojon Road.

The Abu Dhabi Fund for Development (ADFD)

ADFD committed $54m in 2019 in support of five energy and one transport operations. Three of the energy projects were grants, two to Comoros for the supply and installation of seven generators with total capacity of 12.5MW, and one to Somalia ($8m) for a solar power station. Mauritius and Burkina Faso each received a loan of $10m for renewable energy projects. Cameroon received a $15m loan in transport.

In 2020, ADFD committed $33m in support of three renewable energy operations, one each in Togo (solar power plant), Liberia (hydropower plant), and Niger (solar PV plant).

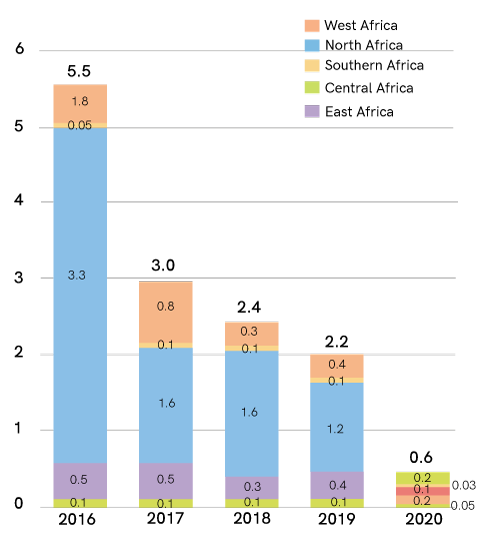

Non-ICA Member ACG Commitments by Sector ($bn), 2016-2020

Non-ICA Member ACG Commitments by Region ($bn), 2016-2020

Sources européennes non ICA 2018

les engagements en faveur des infrastructures en Afrique par les organisations européennes de développement non membresde l'ICA s'élevait à 1,1 milliard de dollars en 2018, soit 31 % de moins que les 1,6 milliard de dollars engagés en 2017, mais nettement plus que les 392 millions de dollars engagés en 2016.

Avec 509 millions de dollars, le secteur de l'énergie représente 45 % du total des engagements, soit un peu inférieure à celle de 2017 (56 %). 336 millions de dollars ont été engagés pour le transport, 199 millions de dollars pour l'eau et l'assainissement. Les engagements dans les TIC s'élevaient à 16 millions de dollars et les opérations multisectorielles, à 12 millions de dollars.

Engagements européens autres que ceux de ICA par secteur, (en millions de dollars) 2018

Banque Européenne pour la Reconstruction et le Développement

La BERD a engagé 744 millions de dollars (66 % du total de ses engagements) dans neuf projets d'infrastructures en Afrique du Nord en 2018, la seule région africaine dans laquelle elle intervient : sept en Égypte et deux au Maroc. 325 millions de dollars (44 %) pour le secteur de l'énergie, 242 millions de dollars pour les transports, 175 millions de dollars pour l'eau et l'assainissement et 3 millions de dollars pour les TIC.

Les engagements de 2018 sont nettement inférieurs aux 1,3 milliard de dollars engagés en 2017. Un prêt de 242 millions de dollars contribuera à financer la modernisation du projet de métro du Caire en Égypte.

Un prêt de 206 millions de dollars pour l'énergie a été consenti à l'Égypte pour aider la Suez Oil Processing Company (SOPC) à financer un ensemble d'investissements dans l'efficacité énergétique et d'autres rénovations et installations.

Un prêt de 93 millions de dollars soutiendra le projet de dépollution des drains de Kitchener en Égypte pour lutter contre la pollution dans le delta du Nil. Le projet permettra également de remettre en état l'infrastructure du drain de Kitchener afin d'améliorer la santé publique. L'UE cofinance l'opération.

Le Fonds International de Développement Agricole (FIDA)

C'est la première année que des données sur l'appui du FIDA aux infrastructures africaine sont présentées. Le FIDA, institution financière internationale et institution spécialisée des Nations Unies, a été créé en 1977 en réponse aux crises alimentaires du début des années 70, lorsque les pénuries alimentaires mondiales provoquaient une famine et une malnutrition généralisées, principalement dans les pays sahéliens d'Afrique. Son objectif est d'éradiquer la pauvreté et la faim dans les zones rurales des pays en développement en soutenant financièrement des projets de développement agricole et en renforçant les politiques et les institutions.

En 2018, le FIDA a engagé 95 millions de dollars dans des réalisations d'infrastructures en Afrique, dont 64 millions de dollars (67 %) ont soutenu le secteur des transports, le reste allant aux TIC (12,3 millions de dollars), aux projets multisectoriels (11,5 millions de dollars), à l'eau et l'assainissement (6 millions de dollars) et à l'énergie (1,6 million de dollars). L'une des opérations de transport, le Family Farming, Resilience and Market Project en Haute et Moyenne Guinée, a reçu un engagement de 31 millions de dollars du FIDA : un prêt de 15,5 millions de dollars et une subvention-cadre de 15,5 millions de dollars pour la viabilité de la dette. Le projet sera cofinancé par l'OFID, le Fonds belge pour la sécurité alimentaire, le Gouvernement de Guinée et les bénéficiaires eux-mêmes.

Financement des organismes bilatéraux

En 2018, les Pays-Bas (198 millions de dollars), la Norvège (47 millions de dollars), la Belgique (24 millions de dollars) et l'Autriche (13 millions de dollars)* ont pris des engagements pour un montant total de 290 millions de dollars, contre 265 millions en 2017 pour les Pays-Bas, la Norvège, la Finlande, l'Autriche et le Danemark. De ces engagements, 183 millions de dollars (65 %) visaient le secteur de l'énergie. Les Pays-Bas ont été le seul pays à cibler le secteur des transports, pour un total de 30 millions de dollars. La répartition régionale montre que 119 millions de dollars (42 %) ont servi à financer des opérations en Afrique de l'Est et 56 millions de dollars (20 %) en Afrique australe. Il n'y avait aucun engagement envers l'Afrique du Nord.

* Données néerlandaises recueillies auprès de la FMO Entreprenurial Development Bank, Norvège auprès de l'Agence norvégienne pour la coopération au développement, Belgique auprès d'Open.Enabel, et Autriche auprès de l'Agence autrichienne de développement. Les données relatives aux autres financements bilatéraux européens non membres de ICA n'étaient pas disponibles.

Les autres sources de financements

Nouvelle Banque de développement (NDB)

La Nouvelle Banque de développement (NDB), une banque multilatérale de développement créée par le Brésil, la Russie, l'Inde, la Chine et l'Afrique du Sud (" BRICS "), a pour principal objectif de mobiliser des ressources pour des projets d'infrastructures et de développement durable dans les BRICS et autres économies et pays émergents. Pour atteindre son objectif, la NDB peut soutenir des projets publics ou privés au moyen de prêts, de garanties, de prises de participation et d'autres instruments financiers. Selon la stratégie générale de la NDB, le développement durable des infrastructures est au cœur de la stratégie opérationnelle de la Banque jusqu'en 2021.

En 2018, la NDB a engagé 500 millions de dollars à l'appui de deux projets d'infrastructure en Afrique du Sud, l'un dans le secteur de l'énergie et l'autre dans celui des transports. Le premier prêt d'un montant total de 300 millions de dollars à la Banque de Développement de l'Afrique Australe vise à faciliter les investissements dans les énergies renouvelables qui contribueront à la production d'électricité et à la réduction des émissions de CO2 en Afrique du Sud, conformément au plan intégré des ressources 2010 du gouvernement sud-africain et à son objectif de réduction des émissions de gaz à effet de serre.

Le deuxième prêt, d'un montant total de 200 millions de dollars, vise à soutenir le développement et la réhabilitation des infrastructures maritimes et terrestres du terminal à conteneurs de Durban.

Banque Asiatique d'Investissement pour les Infrastructures (AIIB)

La Banque Asiatique d'Investissement dans les Infrastructures (AIIB), une banque multilatérale de développement dont la mission est d'améliorer les résultats sociaux et économiques en Asie et au-delà, a commencé ses opérations en 2016. Il investit dans des infrastructures durables et d'autres secteurs productifs afin de mieux relier les gens, les services et les marchés qui, avec le temps, auront un impact sur la vie de milliards de personnes et de bâtir un avenir meilleur. Fin 2018, quatre pays africains étaient membres de l'AIIB : l'Egypte, l'Ethiopie, Madagascar et le Soudan.* L'adhésion de plusieurs autres pays africains est à l'étude.

En 2018, l'AIIB a engagé 300 millions de dollars pour une opération d'approvisionnement en eau et d'assainissement en Égypte, le Sustainable Rural Sanitation Services Program, que la Banque mondiale cofinance avec un appui supplémentaire de 300 millions de dollars.

* La Guinée est devenue membre à la mi-2019.

Africa50

Africa50 est une plateforme d'investissement dans les infrastructures, établie par la BAD, qui contribue à la croissance de l'Afrique en développant et en investissant dans des projets bancables, en catalysant les capitaux du secteur public et en mobilisant le financement du secteur privé, avec des rendements financiers et un impact différents.

En 2018, Africa50 a engagé 78 millions de dollars de financements de projets pour deux projets : pour 48 millions de dollars, elle a acquis 15 % du capital de la Nachtigal Hydro Power Company (NHPC) du gouvernement du Cameroun. Elle a également investi 30 millions de dollars dans Room2Run, une opération panafricaine multisectorielle de titrisation synthétique novatrice de 1 milliard de dollars d'un portefeuille de prêts expérimentés du secteur privé de la Banque africaine de développement.

Africa50 a signé un Accord de développement conjoint avec le Conseil du développement du Rwanda (" RDB "), en vertu duquel Africa50 a le droit exclusif de travailler avec RDB pour concevoir, développer, financer, construire et exploiter certaines composantes de la Cité de l'innovation de Kigali (KIC), qui comprendra un certain nombre de composants TIC. KIC devrait abriter des universités internationales, des sociétés de technologie, des entreprises de biotechnologie et des biens immobiliers commerciaux et de détail sur une superficie de 70 hectares. L'Afrique50 a déclaré 62 millions de dollars de décaissements en 2018.

l'Inde

L'Inde a engagé 762 millions de dollars en 2018, soit un peu plus que les 700 millions de dollars engagés en 2017. Ces engagements visaient deux secteurs : 600 millions de dollars pour l'eau et l'assainissement et 162 millions de dollars pour le transport.

La Banque Ouest Africaine de Développement, BOAD

La BOAD est l'institution de financement du développement des pays membres de l'Union économique et monétaire ouest-africaine (UEMOA). Les pays membres sont le Bénin, le Burkina, la Côte d'Ivoire, la Guinée-Bissau, le Mali, le Niger, le Sénégal et le Togo. Son objectif est de promouvoir le développement équilibré de ses pays membres et de favoriser l'intégration économique en Afrique de l'Ouest en finançant des projets de développement prioritaires.

BOAD a engagé un total de 307 millions de dollars pour des opérations d'infrastructures en Afrique. Sur ce montant, 222 millions de dollars ont été affectés au secteur des transports et 62 millions de dollars à l'appui de trois opérations rurales au Mali, au Niger et au Burkina Faso. Le projet malien comprend la construction d'un échangeur, d'un viaduc et de routes urbaines à Sikasso. Le projet au Niger comprend le pavage de la route Zinder, une liaison de la route Trans-Sahara reliant Alger en Algérie à Lagos au Nigeria. Au Burkina Faso, le financement de 6 millions de dollars contribuera à l'extension du port sec de Bobo Dioulasso, ce qui favorisera la croissance des échanges commerciaux entre pays voisins et ports maritimes.

Six opérations de transport urbain, qui ajouteront 152 km de routes, ont été appuyées par des engagements d'un montant total de 160 millions de dollars, dont la réfection de la route Kédougou-Fouladou au Sénégal, le pavage de la portion urbaine de la route Zinder au Niger, le pavage de la Boucle du Blouf au Sénégal, l'amélioration du réseau collecteur des eaux de pluie de Cotonou au Bénin, le drainage du parc Bangr Wéogo au Burkina Faso et le programme de développement du Bassin du Gourou en Côte d'Ivoire.

Au total, 37 millions de dollars ont été engagés dans le secteur de l'énergie, à l'appui de projets d'électrification urbaine et rurale, dont la construction d'une centrale thermique diesel de 15 MW à Bor, en Guinée-Bissau, et la remise en état des systèmes de distribution électrique au Burkina Faso.

La BOAD a engagé 48 millions de dollars à l'appui de deux projets visant à améliorer l'accès à l'eau potable dans plusieurs quartiers d'Abidjan en Côte d'Ivoire et dans plusieurs quartiers périurbains du Togo.