Résumé 2017

The ICA’s annual report, Infrastructure Financing Trends in Africa 2017, shows that total funding for Africa’s infrastructure development reached $81.6 billion in 2017 – the highest level of directly comparable commitments reported since 2010, and an increase of 22% compared to 2016*.

The biggest single factor driving the higher level of commitments in 2017 was an increase in identifiable Chinese investments, from $6.4bn in 2016 to $19.4bn in 2017. In addition, African national and sub-national government spending rose from $30.7bn in 2016 to $34.4bn in 2017.

The ICA’s annual publication identifies how resources are being mobilised to make an impact on Africa’s infrastructure development. The report covers all sources of infrastructure financing – including multilateral and bilateral donors, African state spending, development banks and the private sector.

The big picture 2017

Total funding reached $81.6bn

Funding increased by

22%

Where the funding came from

Funding distribution by region

Funding distribution by sector

Key findings from the 2017 report include:

- Overall commitments to Africa’s infrastructure development, from all reported sources, rose 22% in 2017 to $81.6bn from $66.9bn in 2016*;

- Total African state spending on infrastructure, at both national and sub-national level, increased from $30.7bn in 2016** to $34.4bn in 2017;

- Chinese investment jumped substantially in 2017, to $19.4bn from $6.4bn in 2016. Chinese funding has fluctuated substantially over recent years, with the 2016 figure of $6.4bn following a high of $20.9bn in 2015 and a low of $3.1bn in 2014;

- ICA members reported commitments of $19.7bn to African infrastructure projects in 2017, an increase of 5% from the $18.6bn reported in 2016. This represents one of the highest commitments since the ICA began collecting data in 2010, only slightly below the 2015 high of $19.8bn;

- Commitments to African infrastructure development by non-ICA members (bilateral and multilateral, excluding China) reached $5.8bn in 2017. Of this, the Arab Coordination Group committed $3bn, compared with $5.5bn in 2016 and $4.4bn in 2015;

- The value of projects with private sector participation reaching financial close in 2017 totalled $5.2bn, an increase from the $3.6bn reported in 2016. Of this, $2.3bn (44.8%) was privately financed;

- With commitments of $34bn, the transport sector continued to be the largest beneficiary of infrastructure commitments in 2017, accounting for nearly 42% of all funding. The energy sector, which recorded $24.8bn of investments in 2017, accounted for 30.4% of the total funding. The water sector accounted for $13.2bn (16.2%), followed by multi-sector investments, which registered $5.1bn (6.3%). Commitments to the ICT sector stood at $2.3bn (2.8%);

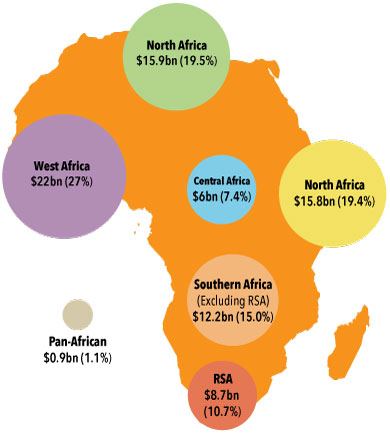

- Of the $81.6bn committed to Africa’s infrastructure development in 2017, West Africa received $22bn of commitments, followed by North Africa with $15.9bn and East Africa with $15.8bn. Southern Africa (excluding South Africa) received $12.2bn, South Africa $8.7bn and Central Africa $6bn.

One of the issues addressed in the 2017 report is African state spending on infrastructure development. The methodology for collecting and compiling data on state spending for infrastructure has been improved for this report, enabling it to capture spending not only at a federal level but also at a sub-national level (e.g. by local governments and utilities) without the risk of double-counting.

The 2017 report also looks at Africa’s infrastructure financing gap, examining the extent to which the lack of investment in infrastructure may be due to a shortage of bankable projects, rather than any lack of availability of financial resources. Stakeholders interviewed for this report suggest that there are enough funds for Africa’s infrastructure development. The challenge, however, is creating more bankable projects.

* Due to new and revalidated data, the 2016 figure of $62.5bn has been restated in this report as $66.9bn.

** Data for 2016 has been adjusted to include identified sub-national spending.