ICA members

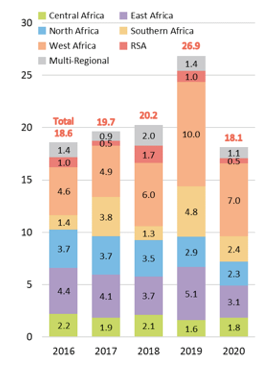

ICA members committed $26.9bn in 2019 and $18.1bn in 2020, compared with commitments of $20.2bn in 2018. 2020 commitments were substantially lower than in previous years since many organizations focused their funding on COVID-19 response and areas such as macroeconomic recovery and health.

Commitments by ICA members had been consistent over the last few years, ranging from $18.6bn to $20.2bn in the 2015-2018 period. An exceptional level of $26.9bn was reached in 2019. The 2020 level of $18.1bn was more in line with historical trends and reflects the major shift in commitments by many ICA members from infrastructure to operations to respond to the impact of the COVID-19 pandemic. Higher commitments reported in 2019 also reflect the contributions from new ICA members who, collectively, contributed $7.4bn.

It should be noted that infrastructure investments are lumpy in nature, which can result in notable year-to-year ICA members commitment fluctuations. Further, MDBs respond to country priorities which can also affect the level of financing from year to year.

ICA Members' Commitments by Source and Region ($m), 2019

ICA Members' Commitments by Source and Region ($m), 2020

ICA Members' Commitments Trends by Sector ($bn), 2016-2020

The energy sector received the largest share of ICA member financing, representing 49% ($13.1bn) of total 2019 commitments and 38% ($7bn) of total 2020 commitments. Commitments to the transport sector accounted for 26% ($6.9bn) of total commitments in 2019 and 26% ($4.8bn) of total commitments in 2020, substantially more than the share of 19% ($3.9bn) reported in 2018, and closer to its 2015-2017 average share of 34%. The water and sanitation sector represented 14% ($3.8bn) of 2019 commitments and 19% ($3.4bn) of 2020 commitments, a lower share than its 2015-2018 share of 25%.

The ICT sector accounted for 7% ($1.9bn) of total commitments in 2019 and 9% ($1.6bn) of total commitments in 2020, markedly higher than the 2015-2018 yearly average of $500m, representing an average of 2% of total commitments during that period.

ICA Members' Commitments Trends by Region ($bn), 2016-2020

Commitments by ICA members experienced a surge in 2019, reaching $26.9bn, the result of the addition of new ICA members who, collectively, contributed $7.4bn ($3.4bn from Afreximbank, $3bn from AFC, $482m from BOAD, and $485 from IsDB), and the inclusion of MIGA, which is part of the WBG, and who contributed $655m Commitments in guarantees. MIGA’s contributions had not been included in previous IFT reports. In addition, larger commitments from AfDB and WB to Southern and West Africa contributed to the overall increase, despite overall decreases in commitments to East and North Africa.

Commitments in 2020 decreased sharply reflecting the shift by many ICA members from infrastructure to sectors most affected by the COVID-19 pandemic.