Spending by African governments on Infrastructure

National expenditure allocations were gathered for 50 African national governments in 2019 and 49 in 2020. As in all previous years, data could not be gathered for Djibouti, Eritrea, Libya, and Sudan. For the first time, data for South Sudan was collected for 2019. No 2020 data could be found for this country. For all countries, data was collected from online, publicly available financial laws or decrees. In all cases, it is assumed that the data presented includes allocations for both capital and recurrent expenditures.

It should be noted that no adjustments to the 2020 allocations could be found, for any country, to reflect the impact of the COVID-19 pandemic. The implication is that the allocations for African national governments include a level of overestimation.

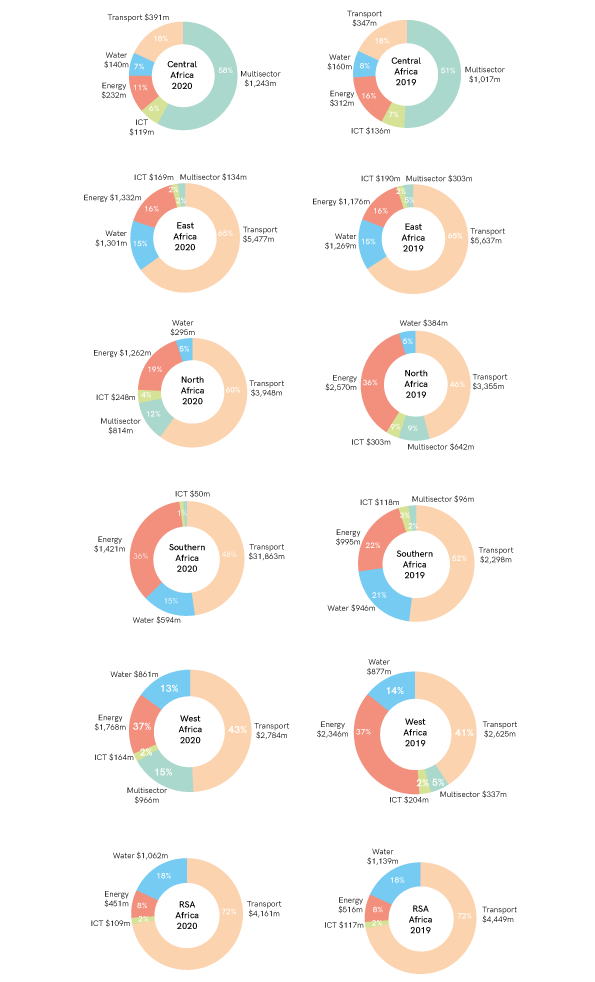

Commitment by Country/Region

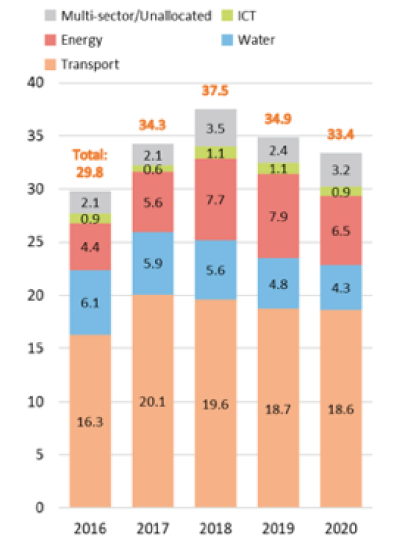

In 2019, commitments made by 50 African national governments totaled $34.9bn, or 7% less than the $37.5bn for 48 countries in 2018. The 2020 commitments made by 49 governments totaled $33.4bn, or 11% less than in 2018.

East Africa is the only region that committed substantially more in 2019 ($8.6bn or 42% more than in 2018) and in 2020 ($8.4bn or 40% more than in 2018), thus reversing the decline over 2017 observed in 2018. The other 4 regions and the Republic of South Africa (RSA) committed less in 2019 and 2020 over 2018: Central Africa (reduction of 22% and 16%), North Africa (9% and 17%), Southern Africa (31% and 39%), RSA (8% and 14%), and West Africa (19% and 17%).

Commitment by Sector

Transport

National budget allocations to the transport sector, at $18.7bn in 2019 and $18.6bn in 2020 were 5% lower than in 2018. In 2019 and 2020, as in previous years, the largest share (54% and 56%, respectively) of infrastructure budgets supported transport operations.

This is slightly above the 52% noted in 2018. There were, however, wide variations at the regional level. See Figure 6.2. East Africa allocated a higher proportion of its infrastructure budget to transport in 2019 and 2020 (respectively, 66% and 65%) than it did in 2018 (58%). So did Southern Africa with 52% in 2019 and 47% in 2020 compared with 46% in 2018.

West Africa’s transport share in 2019 and 2020 were 41% and 43% respectively, in 2018 (41%). North Africa had a lower share in 2019 (46%) and a larger share in 2020 (60%) than it had in 2018 (53%).

Central Africa transport allocation was a markedly lower share (18% in each 2019 and 2020) than it was in 2018 (34%).

At the country level, RSA allocated the largest amounts ($4.4bn in 2019 and $4.2bn in 2020, or 72% of its total infrastructure investment in each year to transport). Several countries had allocations above $1bn in each year: Côte d’Ivoire, Ethiopia, Morocco, Tanzania, and Uganda.

Water and Sanitation

Allocations to the water and sanitation sector amounted to $4.8bn in 2019 and $4.3bn in 2020, compared with $5.6bn in 2018.

The share of national infrastructure budgets allocated to water and sanitation operations was 14% in 2019 and 13% in 2020, slightly lower than the 15% experienced in 2018. The shares in 2019 and 2020 were in line with the 2018 share for Central Africa (8% and 7%, compared with 6%) and West Africa (14% and 13%, compared with 13% in 2018).

East Africa showed allocated a higher proportion to water and sanitation (15% each year, compared with 11% in 2018). North Africa allocated a substantially lower proportion of total infrastructure budget to water and sanitation in 2019 and 2020 (3% and 6%, respectively, compared with 12% in 2018). Southern Africa also allocated a lower share (21% in 2019 and 15% in 2020, compared with 24% in 2018). At the country level, RSA allocated $1.1bn to the water and sanitation sector in 2019 and in 2020, slightly lower than the $1.3bn it had allocated in 2018. Ethiopia allocated over $500m in each year.

Energy

Allocations to the energy sector in national budgets amounted to $7.9bn in 2019 and $6.5bn in 2020, compared with $7.7bn in 2018.

The share of allocations to energy rose from 21% in 2018 to 23% in 2019, the result of North Africa allocating 35% of its infrastructure budget to energy operations, and West Africa allocating 37%, compared, respectively to 20% and 32% in 2018.

Allocations in Egypt, Nigeria, and Tunisia accounted for 40% of energy allocations in 2019. The share of energy dropped in 2020 to 19% of total allocations. Tanzania had the highest allocation ($857m). Algeria, Angola, Côte d’Ivoire, Egypt, South Africa, and Zimbabwe each had allocation close to or higher than $500m.

ICT

National allocations to the ICT sector remained stable, amounting to $1.1bn in 2019 and $0.9bn in 2020, compared with $1.1bn in 2018. They represented 3% of total allocations in each 2019 and 2020, the same proportion as in 2018.

Allocations in Egypt and South Africa accounted for 26% of total country allocations in ICT in 2019 and 37% in 2020. They for the most part represented participation in financing for subsea cables and fiberoptic interconnection links.

Multi-Sector

Multi-sector operations totaled $2.4bn in 2019 and $3.2bn in 2020, compared with $3.5bn in 2018.That corresponds to a share of 7% of total infrastructure budgets in 2019 and 10% in 2020 (compared with 9% in 2018), the highest share ever achieved. Central Africa had the largest proportion of multi-sector operations, which represented 52% in 2019 and 59% in 2020 of its total allocations, an even higher proportion than the 36% noted in 2018.

National Government Budget Allocations by Sector ($bn), 2016-2020

Regional National Government Budget Allocations by Sector ($m), 2019-2020