2016 Overview

The Infrastructure Financing Trends in Africa 2016 report shows that new commitments to Africa’s infrastructure development totalled $62.5bn in 2016, a decline of over 20% compared to 2015.

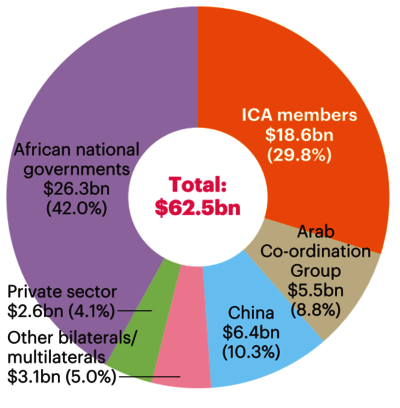

This comprised $26.3bn of budget allocations from African national governments, compared toS$24bn in 2015, and external finance of $36.2bn – the lowest level since 2010. The drop in external finance in 2016 compared to 2015 was largely due to a $14.5bn reduction in reported Chinese funding and a $4.9bn fall in private sector investment.

Total Financing by source 2016

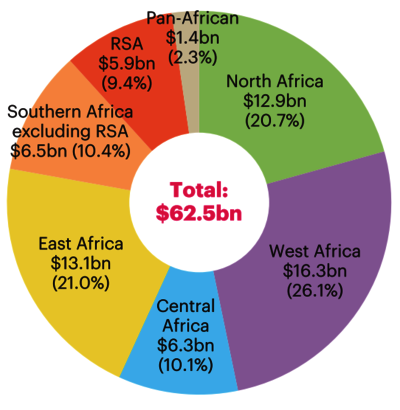

Total financing by region 2016

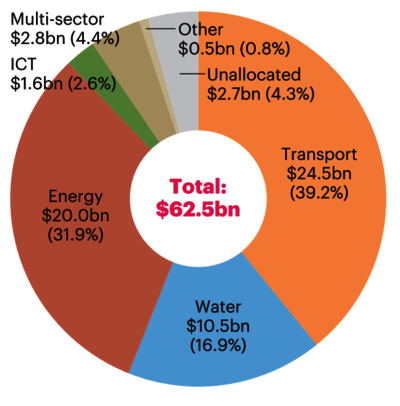

Total financing by sector 2016

Other key findings from the 2016 Infrastructure Financing Trends in Africa report include:

- Overall commitments to Africa’s infrastructure development, from all reported sources, declined in 2016 by 20.8%, to $62.5bn from $78.9bn in 2015;

- The total amount of identifiable infrastructure allocations by African national government budgets came to $26.3bn in 2016, up 9.6% from $24bn in 2015;

- Chinese funding of Africa’s infrastructure development has fluctuated substantially over recent years, with the 2016 figure of $6.4bn following a high of $20.9bn in 2015 and a low of $3.1bn in 2014. Between 2011 and 2016, Chinese investment has averaged $12bn;

- In total, ICA members reported commitments of $18.6bn, down 6% from $19.8bn in 2015. Excluding the exceptional $7bn contribution from the Power Africa initiative in 2013, commitments from ICA members have remained broadly consistent for the past five years at an average of $18.9bn;

- Members of the Arab Co-ordination Group (ACG) committed $5.5bn in 2016 to Africa’s infrastructure development, a steady increase on 2015 ($4.4bn) and 2014 ($3.5bn);

- The value of projects with private sector participation reaching financial close in 2016 was $3.6bn, of which $2.6bn was private capital. This is a significant decrease on the private capital recorded in 2015 ($7.4bn) and 2014 ($5.1bn);

- Commitments to the water sector increased substantially from $7.5bn in 2015 to $10.5bn in 2016. Commitments to the transport sector fell sharply in 2016 to $24.5bn, compared with $32.4bn in 2015. Financing of energy projects in Africa fell to $20bn in 2016, from the record high of $33.5bn in 2015. ICT sector commitments stood at $1.6bn in 2016, less than the $2.4bn reported in 2015;

- Of the $62.5bn committed to Africa’s infrastructure development in 2016, West Africa received $16.3bn of commitments, followed by East Africa with $13.1bn and North Africa with $12.9bn. Southern Africa (excluding South Africa) and Central Africa received $6.5bn and $6.3bn, respectively, while South Africa received $5.9bn.