Energy Financing Trends

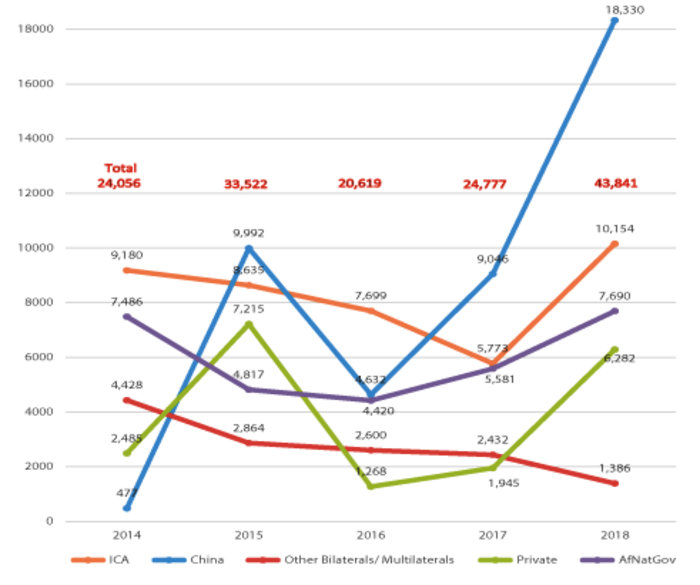

Energy sector commitments in 2018 amounted to $43.8bn, 67% higher than the 2015-2017 average. This is the largest level of commitments ever recorded in the sector and the largest allocation of commitments (44% of total). The result of more than a doubling of commitments by China, which reached $18.3bn in 2018 from $9bn in 2017. The significant increase included some very large projects such as a hydropower project in Nigeria funded by a $5.8bn loan from China, and a $4.4bn loan to support a coal project in Egypt. Private sector commitments amounted to $6.2bn. Further, ICA members committed $4.4bn more in 2018 than in 2017, and African governments added $2.1bn to their energy commitments in 2018.

Funding from ICA members for energy operations amounted to $10.2bn, close to half of total commitments, establishing the energy sector as the sector receiving the largest share of ICA member financing in the 2014-2018 period, with the exception of 2017, when the transport sector had received the largest share of financing.

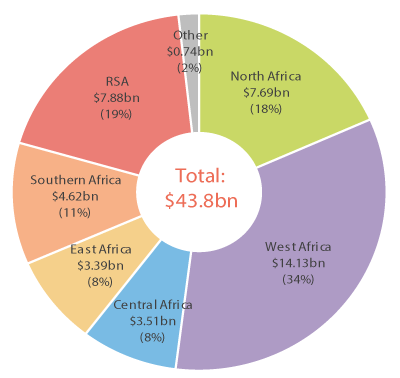

Allocations to the energy sector in national budgets amounted to $$7.7bn in 2018, $2.1bn (38%) more than in 2017. The share of allocations to energy went from 16% in 2017 to 20% in 2018. Most of the increase (91%) is the result of a $1.9bn increase in the allocation West African countries made to their energy sector. North Africa more than doubled its allocation, going from $777m in 2017 to $1.6bn in 2018. These large increases were somewhat offset by an allocation reduction in South Africa ($513m).

Total energy sector financing by source, 2014-2018

Total Energy Financing by region 2018