Key Achievements in the financing of African infrastructure in 2019 - 2020

Total commitments in 2020 were 10% lower than in 2019, largely because of the impact of COVID-19.

COVID-19 impacted African countries differently in terms of cumulative cases, hospitalizations, and deaths. The resulting economic contraction also impacted African countries differently and reflected varying levels of declines in consumption and investment caused by considerable consumer and investor uncertainty, lockdowns, containment measures, and disruptions in supply chains (domestic and external). Service sectors, including construction, have been the most affected.

Infrastructure sectors, particularly the energy, transport, and water sectors, faced wide- ranging challenges. Country resources were diverted towards emergency spending on health, social issues, and economic stimulus efforts. Infrastructure projects suffered, as many countries and financial institutions were affected by rating downgrades that made it more difficult to obtain finance. Fifty-six percent of rated African countries were downgraded – significantly above the global average of 31.8% and the averages in other regions (45% in the Americas, 28% in Asia, and 9% in Europe).

Travel restrictions and lockdowns resulted in delays in project preparation. Negotiations between the public and private sectors that were necessary to close complex PPP projects proved more difficult to do via video conference than face to face.

Supply chain disruptions and price increases affected the implementation of many energy projects, particularly solar. A number of projects under construction were affected by foreign contractors leaving the continent at the beginning of the pandemic.

The broad decline in economic activity also resulted in job losses that reduced the ability of consumers to pay tariffs, especially electricity tariffs. A recent report indicates that 30 million people are expected to lose electricity connections due to COVID 19, which affected the finances of multiple electric utilities. Proposed power utility investments involving the private sector that were not closed before the pandemic hit, were affected by investor concerns about financial risks arising from COVID.

The decline in total infrastructure commitments from $85bn in 2019 to $81bn in 2020 in part due to the shift by some bilateral and multilateral organizations from infrastructure to operations to address the effect of the COVID-19 pandemic, particularly in the health and macroeconomic sectors. The IMF provided emergency assistance to 39 African countries amounting to over $25.5bn in 2020 alone6. Without this assistance, infrastructure investments would likely have dropped even further.

The big picture 2019 -2020

Where the funding came from

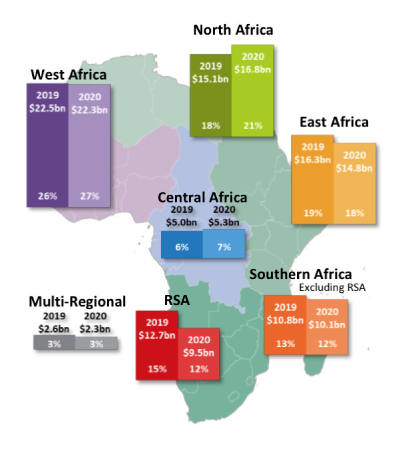

Funding distribution by region

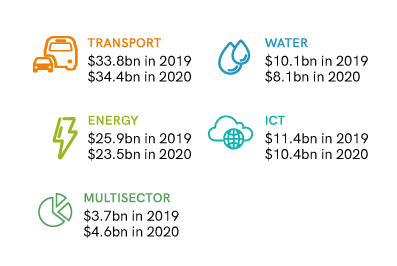

Funding distribution by sector

Key findings from the 2019-2020 report include:

- African Governments continued to provide the largest share of commitments.

- After a surge in 2019, ICA members’ commitments in 2020 stabilized at 22% of total commitments, slightly higher than their 20% share in 2018.

- Commitments by the private sector reached $19bn in 2020, the highest level on record.

- The share of commitments allocated to transport has increased over the last few years, going from 32% in 2018 to 42% in 2020.

- Financing gaps remain substantial in all sectors except ICT and have increased markedly in water and sanitation over the last 4 years.

- Financing gaps are significant and growing for all sectors except ICT where targets for provision of basic connectivity have been reached.

- Funding from the private sector is growing, especially for ICT, but could make a much greater contribution to overall funding with more cost-reflective tariffs and user fees.

- With 27 new PPP projects closed in each of 2019 and 2020, Public-Private Partnerships continue to contribute to overall infrastructure investment but remain constrained in terms of providing greater amounts of private funding. They exhibit considerable variability from year to year.

- Infrastructure projects are a key driver of regional integration and are weaving the continent together.

- The private sector is potentially a significant source of financing for African infrastructure, but is held back by concerns of sector creditworthiness, perceptions of political risk, and bureaucracy and red tape.

- New institutional models for infrastructure finance are emerging, like the creation of an Africa Infrastructure Asset Class and caisses de dépôts already established in several African countries.

- The 2019 G20 Quality Infrastructure Investment Principles offer a sound template for improving the quality of African infrastructure.

- While Africa has seen some notable renewable energy projects in recent years, the continent is lagging in the global energy transition from fossil fuels (notably coal) to natural gas (as a transition fuel) and renewables.

- Several institutions joined ICA in 2019 and helped deliver the highest level of commitments since 2011.

- MDBs accounted for 78% of ICA financing in 2019 and 79% in 2020.

- The energy sector received 49% of ICA commitments in 2019 and 38% in 2020.

- Commitments to West Africa accounted for 37% of 2019 commitments and 38% of 2020 commitments.

- Disbursements reached an all-time high of $23.9bn in 2019.

- Non-ICA members committed the largest share of total financing in 2019 (56%) and in 2020 (54%)

- African governments provided about three-quarters of non-ICA public finance commitments.

- China markedly reduced its commitments, reflecting the debt sustainability challenges faced by many African countries.

- IsDB and BOAD became ICA members in 2019. Their contributions are therefore no longer included in the group of Other Public Sources, which accounts for some of the reduction in commitments.

- While financial commitments remained steady, the financing gap in transport has been increasing

- A new, more realistic approach to water and sanitation tariffs would help the financial sustainability of the sector and lead to the faster extension of service to unserved areas.

- The energy transition away from coal and hydrocarbons has high start-up costs but lower costs in the long term; it is advancing faster in some African regions than in others.

- The ICT sector is a major success story in Africa and its financing gap has been bridged, mostly by funding by the private sector.

- West Africa received the largest share of commitments in 2019 and 2020, in line with its 2016- 2018 average.

- Commitments to Central Africa sharply decreased in 2019 and stabilized at that lower level in 2020.

- North Africa commitments declined in 2019 but regained strength in 2020, exceeding their 2016-2018 average level.

- Commitments to Southern Africa and to RSA experienced sharp drops in 2019 and 2020 from their 2018 levels but stabilized above their pre-2018 average levels.