Water Financing Trends

Water and sanitation sector commitments, at $13.3bn, were 21% above the previous 3-year average of $11bn. These commitments remained essentially at the same level as 2017, $13.3bn in 2018 compared with $13.2bn in 2017.

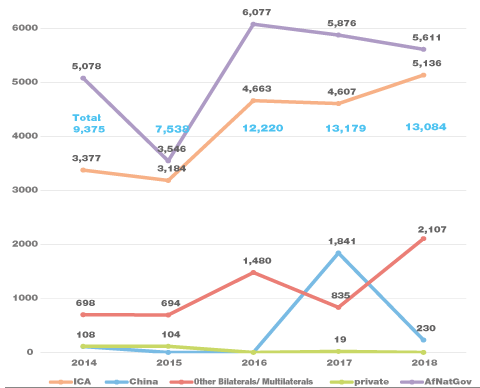

The financing of $5.1bn in the water and sanitation sector from ICA members in 2018 represents around 25% of total commitments, in line with its representation in 2016 of $4.7bn and 2017 of $4.6bn.

At $5.6bn, national budget allocations to the water and sanitation sector are only slightly less than the $5.9bn allocated in 2017, and slightly above the 2014-2017 average of $5.2bn. They accounted for 15% of the total national budget allocations. At the regional level, the largest change was a $718m increase from Southern Africa. The allocation for South Africa was lower by $1bn. Smaller changes were experienced in West Africa, with an increase of $364m, and East Africa, with a decrease of $334m.

China’s financing for water and sanitation sector amounted to $230m.

Total water sector financing by source, 2014-2018

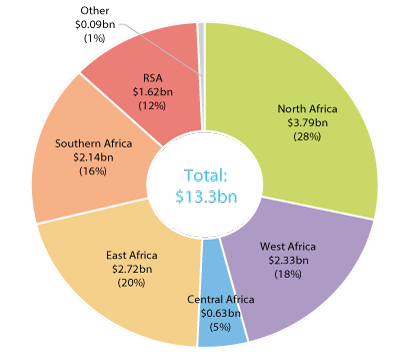

East Africa accounted for the largest share (31%) of new investment in the water & sanitation sector across Africa. East Africa displaced North Africa (20%), which was the most popular financing destination in both 2015 and 2016. Investments in the Republic of South Africa accounted for 18% of financing of Africa’s water sector, while Southern Africa and West Africa accounted for 12% each. Only 7% of new funding for water and sanitation was invested in Central Africa.

Total water sector financing by region, 2018