Who is financing Africa’s Infrastructure?

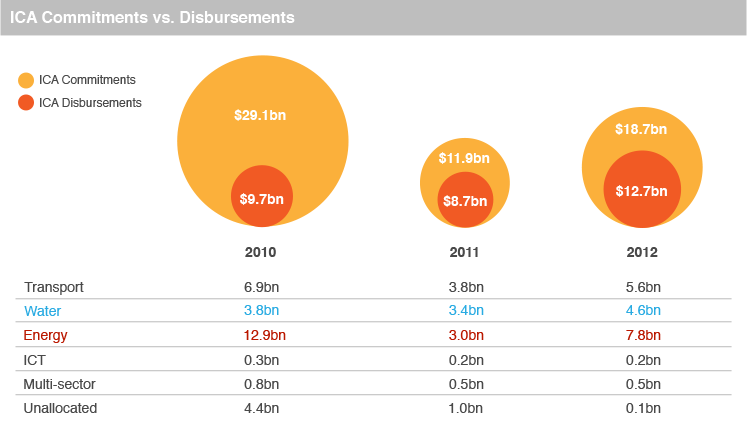

There are some interesting trends in commitments vs. disbursements made by ICA members between 2010-2012. There were wide swings in the levels of commitments: notably in the energy sector. North Africa and The Republic of South Africa had enormous energy projects which shadowed the rest of the continent in terms of energy investments. Though there is consistent commitment to energy projects, water project commitments grew steadily over the three year period.

The level of actual ICA member disbursements lags behind commitments – illustrating how deploying finance is often subject to delays. It is, however, very encouraging to see disbursements of $12.7bn were made in 2012 – compared with $8.7bn in 2011 and $9.7bn in 2010. But again, over that three year period of time nearly $60bn of commitments were made while actual disbursements amounted to about $31bn.

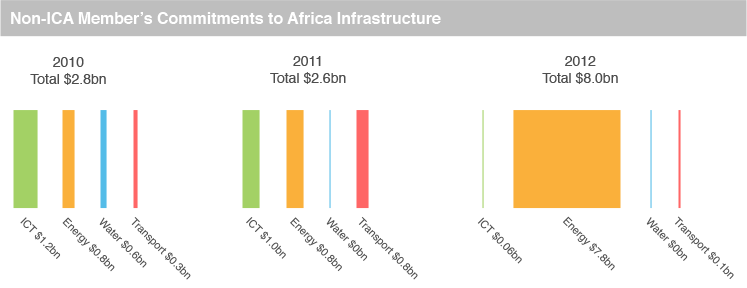

Non-ICA Member’s commitments to Africa infrastructure have broken the $20bn ceiling for the first time – even though China’s contribution fell back from$14.9bn in 2011 to $13.4bn in 2012. This was more than compensated for by the Arab Coordination Group –which tends to invest in a greater number of smaller projects than some other funders.

There is an overwhelming preference for private capital to flow into energy projects.

GENERAL CONCLUSION: There is a need to attract private investment to diversify – outside the energy sector. Also, there is a need to attract energy investments to other regions than North and South Africa.